virginia estimated tax payments safe harbor

Make tax due estimated tax and extension payments. If you expect to owe less than 1000 after subtracting your withholding youre safe.

Estimated Tax Due Dates Do I Still Need To Pay

What is the safe harbor for estimated taxes.

. The extension penalty and late payment penalty will be assessed as follows. Here is the main part of the Safe Harbor Rule. Tax due reported on return - 200000.

The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up owing for the year or at least. The penalty on the last payment is the same as calculated above but the third. Pay all business taxes.

Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to pay. Underwithholding by more than 25 means your last two payments were probably too low. Extension penalty 3 months 2 per month - 12000.

The safest option to avoid an underpayment penalty is to aim for 100 percent of your previous years taxes If your. As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year 2019. With respect to any installment the.

1 Best answer. Luckily in some cases you may be able to avoid paying them thanks to the estimated tax safe. The IRS will not charge you an underpayment penalty if.

In fact this is one. Pay bills or set up a payment plan for all individual and business taxes. Generally an underpayment penalty can be avoided if you use the safe harbor rule for payments described below.

Not paying enough in estimated tax payments can mean unpleasant penalties. The fourth and final 2022 estimated tax payment is due January 17 2023. If we were to permit the addition to tax for 1998 to be adjusted for a subsequent amended return then logic would compel us to similarly adjust the addition to tax on the 1999.

90 of the tax liability for the related tax return or. Pay bills or set up a payment plan for all individual and business taxes. You pay at least 90.

If your AGI was more than 150000 75000 if your filing status is. Pay Online provides complete tax payment information how and when to. If your adjusted gross income for the year is over 150000 then you must pay at.

If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. The following definitions apply only to the computation of the addition to the tax for failure to pay estimated tax. If you pay 100 of your tax liability for.

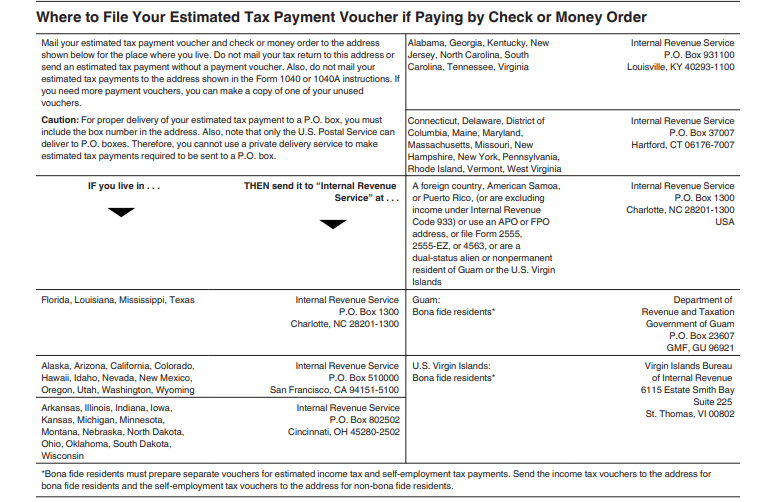

Quarterly estimated tax payments refer to money owed to the IRS to help make payments against the tax liability youre going to file for on April 15 or your extended deadline respectively. Estimated tax safe harbor. The estimated safe harbor rule has three parts.

Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year. 100 of the total tax liability shown your previous years tax return. January 9 2020 329 PM.

Understanding Virginia S Tax Withholding Rules Marotta On Money

How Does The Federal Individual Income Tax Extension Affect You

5469 Safe Harbor Ct Fairfax Va 22032 Mls Vafx2061706 Redfin

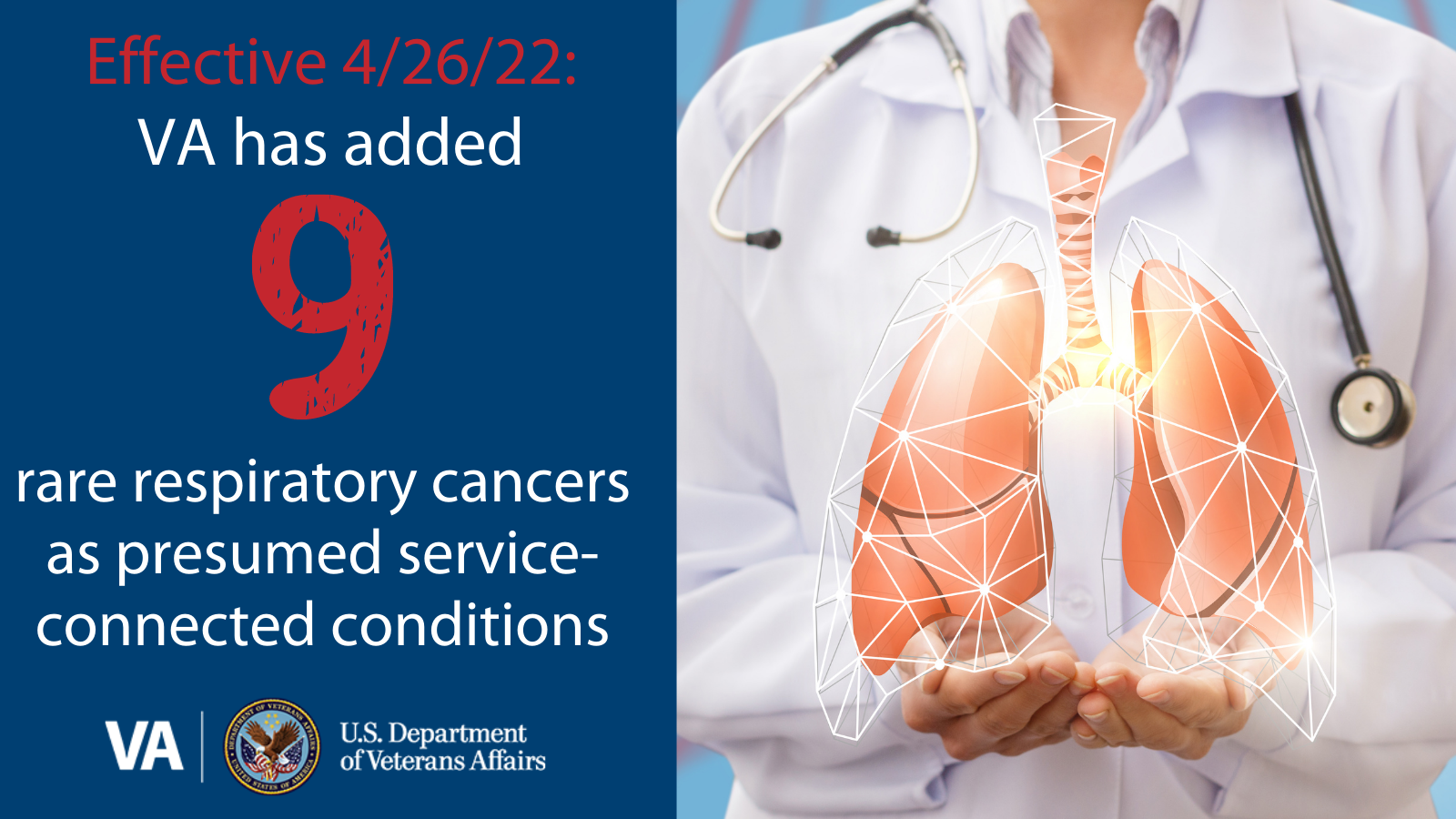

Veterans Benefits 2020 Most Underused State Benefit Va News

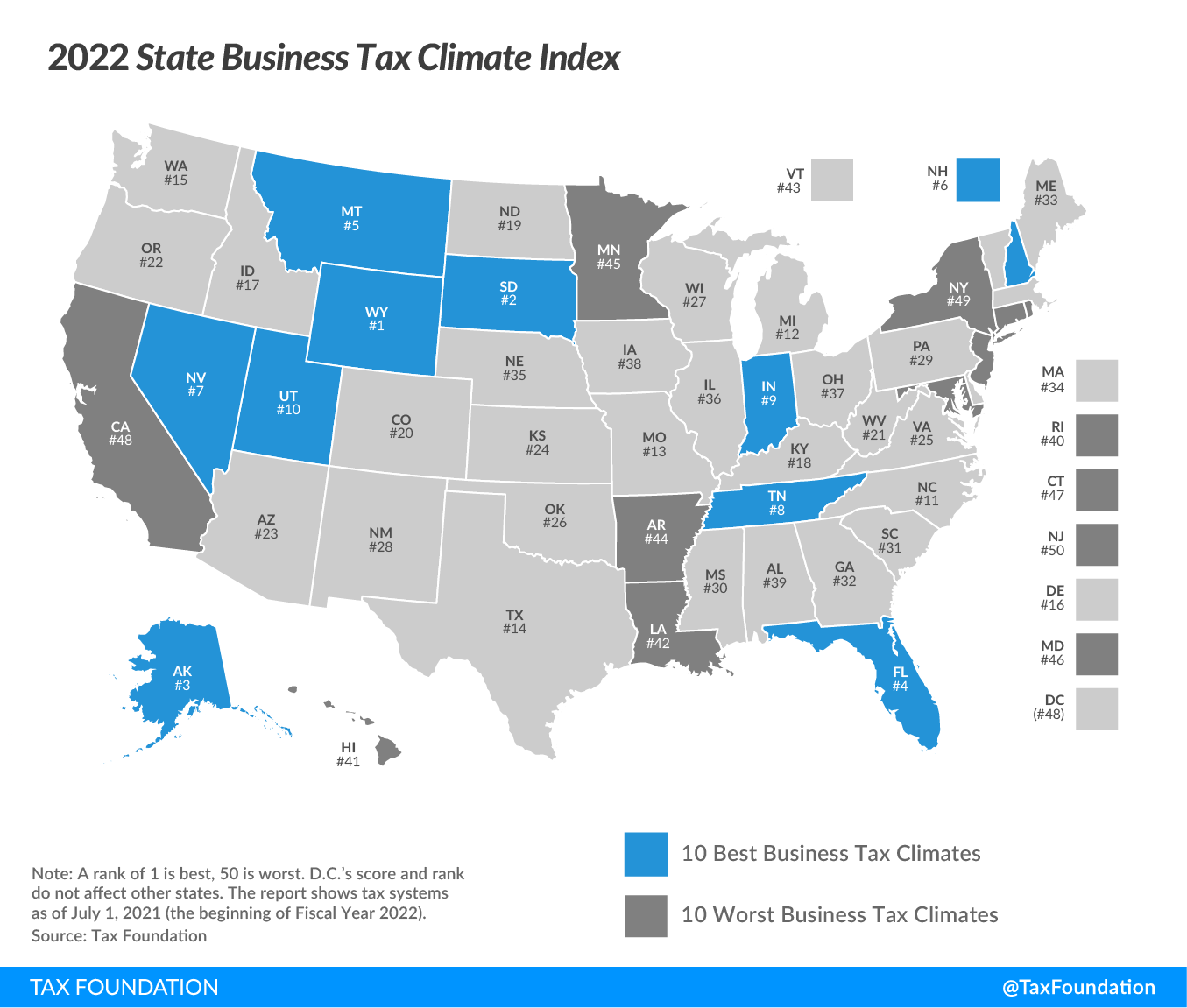

2022 State Business Tax Climate Index Tax Foundation

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

5469 Safe Harbor Ct Fairfax Va 22032 Mls Vafx2061706 Redfin

Repealing Virginia S Grocery Tax A Look At The Proposals And Revenue Loss Wric Abc 8news

Estimated Tax Payments How They Work And When To Pay Them Bankrate

What If You Haven T Paid Quarterly Taxes Mybanktracker

Nine New Cancers Added To The Presumed Service Connected List Related To Particulate Matter Va News

5487 Safe Harbor Ct Fairfax Va 22032 Mls Vafx2010276 Redfin

Quarterly Estimated Tax Payments What You Need To Know

State And Local Tax Advisor April 2021 Our Insights Plante Moran